Assuring that every cash transaction made is posted to the appropriate account is important as well in order to keep information organized within the journal. A cash receipts journal is a subsidiary ledger in which cash sales are recorded. This journal is used to offload transaction volume from the general ledger, where it might otherwise clutter up the general ledger.

- Shoeboxed is an expense & receipt tracking app that helps you get reimbursed quickly, maximize tax deductions, and reduce the hassle of doing accounting.

- Whereas the cash disbursement record would include items like payments made to vendors to lower accounts payable.

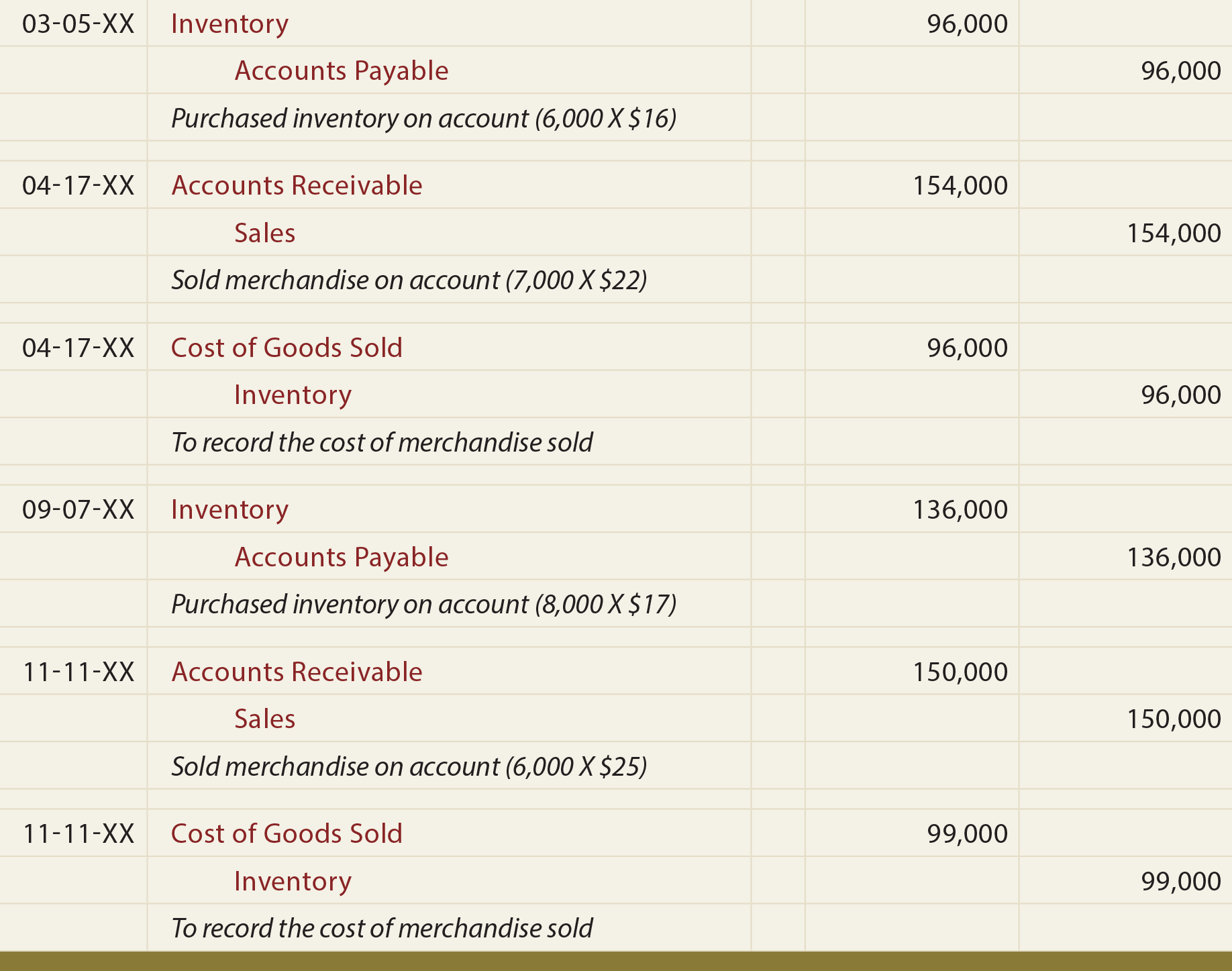

- The Cost of Goods Sold account, and expense account, is debited for the same cost as the inventory was recorded at, as shown below.

- These two journal entries are generally booked simultaneously, as one action (selling an item to a customer) drives the need to book both of them.

- Cash payments are accounted for by crediting the cash / bank ledger to account for the decrease in the asset.

- It also ensures that the business can keep track of all the account receivables and aged receivables.

Create the cash received entry

Since no cash is received from credit sales transactions, they are not recorded in an accounting journal. Credit sales are handled using the accrual basis of accounting, while cash transactions are handled using the cash basis. In contrast the credit entry is to the accounts receivable control account in the general ledger, and represents the reduction in the amount outstanding from the credit sale customers. Had the cash receipt journal recorded other items such cash sales, fixed asset sales etc. then the credit would have gone to the appropriate sales or fixed asset disposal account. A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals.

Cash Receipts Journal Totals Used to Update the General Ledger

As they are posted, the account numbers are placed in the post reference column. This ensures that the individual customers’ accounts are up to date and accurately reflect the balance owed at that date. You can also contact us if you wish to submit your writing, cartoons, jokes, etc. and we will consider posting them to share with the world! The Facebook and LinkedIn groups are also good areas to find people interested in accounting like yourself, don’t hesitate to join as everyone of all levels are welcome to become part of the community. Obviously if cash is involved, that will be one side of the entry, and the other will depend on the type of transaction you are performing.

Combination of cash and credit

The accountant would then use the reference number obtained from the journal to search through source materials and identify the specific receipt in question. The business has a cash receipt of 500 from a customer relating to a sales invoice already posted to cash receipt journal entry the sales ledger and accounts receivable (trade debtors) control account. To ensure your books are accurate, you need to understand cash receipts accounting. Read on to get the inside scoop about managing and recording cash receipts in your small business.

To Ensure One Vote Per Person, Please Include the Following Info

By contrast, balances in cash accounts are commonly reconciled at the end of the month after the issuance of the monthly bank statement. There are several types of cash books that entities can use, whether they’re businesses or individuals. We’ve highlighted some key details about single-, double-, and triple-column cash books with examples of what each looks like below. A cash disbursements journal is the counterpart to the cash receipts journal.

The general format of a cash receipt journal can look like the following. However, it must include some key information points relevant to the cash transaction. Let us discuss the cash receipt format and its uses along with the cash receipt journal. The three column cashbook is sometimes referred to as the triple cashbook, treble cashbook or the 3 column cashbook. Record the name of the account that is credited in the ledger as a result of the cash received.

The petty cash book may be considered to be a fourth type of cash book. A journal is where financial transactions are first recorded and are recorded chronologically with a brief explanation. The ledger sorts and groups accounts from the journal’s business transactions showing the summaries and totals of each individual income and expense account in the receipt ledger. These entries above will cover most of the different types of journal entries for a cash transaction.

Since all transactions are recorded in the general journal, it can be extremely large and make finding information about specific transactions difficult. That is why the general journal is divided up into smaller journals like the sales journal, cash receipts journal, and purchases journal. A sales journal entry is a journal entry in thesales journalto record a credit sale of inventory.

The amount of $506 is then placed in both the cash debit column and the sales credit column. As before the first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). The three column cashbook uses three columns on each side of the book. This format in effect combines both two column formats discussed above in that it uses the additional columns to record both discounts and bank account transactions.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A check is placed under the total of this column as this total is net posted. Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit) . Because the cash book is updated continuously, it will be in chronological order by transaction. In the description column, the accountant writes a short description or narration of the transaction. In the reference or ledger folio column, the accountant inputs the account number for the related general ledger account.